FOR IMMEDIATE RELEASE – December 19, 2005

TAKING AIM AT HIGH PROPERTY TAXES,

COMPTROLLER EXPANDS AUDITS OF SPECIAL TAX DISTRICTS;

CALLS FOR COUNTYWIDE CONFERENCE TO RECOMMEND REFORMS

Local Water Districts to be Examined Next; Weitzman Issues “White Paper” Citing Widespread Lack of Oversight, Accountability

Saying that many of Nassau County’s more than 200 special tax districts may be seriously mismanaged and unaccountable to taxpayers, Nassau County Comptroller Howard Weitzman today released a “white paper” on the districts calling for a bipartisan Nassau County conference on special tax districts to oversee a comprehensive review of their structure, operations and budgets, and recommend “whether they should continue to exist, be combined, or otherwise be reformed.”

At the same time, Comptroller Weitzman said his office will immediately begin a financial review of nine local water districts, three in each of Nassau’s three towns. Following this review, the Comptroller will select a smaller group of districts to undergo full operational and financial audits.

“If we are ever going to contain property taxes in Nassau County, we need to find ways to reduce the number of taxing jurisdictions in this county and make them more accountable to taxpayers,” Comptroller Weitzman said at a news conference today in Mineola.

“Nassau has far too many layers of government. In addition to the county, three towns, two cities and 64 villages, there are more than 200 other districts with taxing authority, not including school and library districts. They have wildly varying tax rates, and, unfortunately, many of them have little or no public accountability.

“Our analysis of this issue is contained in a white paper we are releasing today entitled, “Nassau County Special Districts: The Case for Reform.” Based on our experience auditing sanitary districts earlier this year, we are convinced that a lack of oversight and transparency is common in commissioner-run special districts, and may well exist in other types of special districts. The effect is all too clear – waste, inefficiency, and sometimes worse, with Nassau’s beleaguered taxpayers footing the bill.”

The goals of the comprehensive review of special districts will be to:

- examine the structure, operation and budgets of all special districts operating in Nassau County;

- recommend changes to the structure and governance of special districts, including consideration of whether existing commissioner-run districts should be combined, merged into town-run districts, or disbanded, and of whether existing town-run districts should be combined;

- review the sufficiency of existing oversight, and the need for additional legislation and controls to increase accountability and transparency;

- examine whether there should be legislative reform of the election process.

“In short, we must formulate a master plan for the 21st-century provision of services currently provided by special districts that were formed in response to the needs of the early 20th century,” Comptroller Weitzman said.

New York State Comptroller Alan G. Hevesi said, “Comptroller Weitzman has performed an important public service with his audits of the sanitary districts and now his white paper on the many levels of government in Nassau County. Both his audits and ours have clearly shown that when there is no oversight, some organizations will be well run, some will be poorly run, and in some there will be corruption. Clearly, there are too many government bodies with too little oversight. I support his call for a Nassau County conference to bring together all the parties to develop a plan for maintaining services while reducing the cost to taxpayers.

County Executive Thomas R. Suozzi said, “I commend the Comptroller for leading a coordinated bipartisan effort to increase the accountability of the hundreds of special taxing districts in Nassau County,” said County Executive Tom Suozzi. “Combined with the campaign we have already begun to find a way to reduce school taxes, the single largest tax burden on our residents, this is another important step in our fight to reduce the tax burden across the county.”

Comptroller Weitzman said, “It’s clear that high taxes already is the number one issue in Nassau County. But taxpayers have become even more concerned this year as reports of waste and abuse surfaced in one local tax district after another. We have seen revelations about the misappropriation of funds by local school district officials; waste and abuse at local sanitary districts; and over-spending by local fire departments, as detailed in Newsday’s recent investigative series. These reports demonstrate how easily excessive and wasteful spending, and poor personnel, contract and property management practices, can flourish in the absence of rigorous financial controls, and oversight.

“People are beginning to “connect the dots” between these wasteful practices and high property taxes. Therefore, I believe the public may be more willing than ever before to consider new ideas for streamlining or consolidating this overabundance of local government, and making it more financially responsible. I believe this can be accomplished with no reduction in the quality of local services,” Comptroller Weitzman said.

“In the area of school spending and taxes, I have joined with County Executive Tom Suozzi in his Educational Summit, which earlier this month brought together school board leaders from across the county to consider ways of restraining school taxes. A similar countywide effort is needed for the more than 200 other taxing authorities. Although less onerous than school taxes, the taxes they impose still contribute significantly to our high tax burden.”

Town of North Hempstead Supervisor Jon Kaiman, appearing with Comptroller Weitzman at today’s news conference, said, “It is our goal in North Hempstead to serve as a resource to our special districts in the future. If we work together we can save money while providing essential services to our mutual constituencies.”

The countywide conference on special districts should include all major stakeholders, such as local and district officials, state legislators, and representatives of community and business groups, Comptroller Weitzman said. To facilitate planning for the event, the Comptroller’s Office will distribute copies of the report “Nassau County Special Districts: The Case for Reform” to district, town, county and state officials. Copies will also be available on the Comptroller’s Web site, www.nassaucountyny.gov/comptroller.

Comptroller Weitzman also disclosed today that his office will continue its audits of the special districts, focusing next on local water districts.

The water districts selected for review are:

- Town of North Hempstead: Manhasset/Lakeville, Garden City Park and Westbury.

- Town of Oyster Bay: Jericho, Hicksville, and Plainview.

- Town of Hempstead: Franklin Square, West Hempstead and East Meadow.

The districts, including both town-run and commissioner-run districts, were selected after an analysis of financial statements and a comparison of the property tax burdens for all water districts. The analysis compared such factors as district revenues, expense levels, tax rates fund balances, and year-to-year increases or decreases in expenses.

The water district audits follow the Comptroller’s reviews earlier this year of five garbage collection districts in the three towns, which found millions of dollars in waste and extremely lax financial controls in four out of five districts.

The white paper released today reviews the history and development of special tax districts in the county and examines lessons learned from the 2005 audits of five commissioner-run sanitary districts. In four of the sanitary districts, auditors found serious financial mismanagement, a lack of oversight, few, if any, written policies and procedures, overspending, faulty contracting, and questionable employment and benefit practices. As a result of the audits, the State Comptroller and the District Attorney initiated independent investigations, which are currently ongoing.

The white paper finds that many of the 200-plus special taxing districts in Nassau have certain attributes in common:

- a lack of budget accountability; i.e., district budgets are often not reviewed by a higher government body, such as a town board, even if statutory authority may exist for such reviews;

- a lack of transparency; e.g., few or no public meetings and a lack of information about district operations made available to the public;

- inadequate administrative, personnel and financial controls, resulting in unnecessarily high costs to taxpayers; and

- elections held at inconvenient times for which little public notice is given, and for which voter turnout is unacceptably low.

It concludes that “the significant problems we identified in the commissioner-run sanitary districts we examined to date are not isolated instances, and may well exist in other types of commissioner-run special improvement districts.” The report recommends that “a comprehensive examination of all commissioner-run special districts should be undertaken. In addition, we believe the structure and administration of town-run special districts should be examined. As a first step, we recommend that all stakeholders, including local and district officials, state legislators, and representatives of community and business groups meet to establish a plan for conducting a comprehensive examination of county special districts and for the development of recommendations for reform.”

Since the problems identified in the operations and administration of special districts may not be limited to Nassau County, the report also suggests that a state legislative committee be established to investigate the many layers of local government in New York.

end

Stacey Kent, Jim Tomlinson, and Kazuo Ishiguro “Wish They Could Go Travelling Again” (Jazziz, April 2021)

Stacey Kent, Jim Tomlinson, and Kazuo Ishiguro “Wish They Could Go Travelling Again” (Jazziz, April 2021) Maria Schneider Profile/Interview (DownBeat, 12/16 Cover Story)

Maria Schneider Profile/Interview (DownBeat, 12/16 Cover Story) Jon Batiste's Love Riot (DownBeat, April 2017)

Jon Batiste's Love Riot (DownBeat, April 2017) Anat Cohen – "Perfect Accent" (DownBeat, July 2017)

Anat Cohen – "Perfect Accent" (DownBeat, July 2017) Wynton Marsalis – Building the Cathedral (DownBeat, Dec. 2017)

Wynton Marsalis – Building the Cathedral (DownBeat, Dec. 2017) Kurt Elling on "The Questions" (DownBeat June 2018)

Kurt Elling on "The Questions" (DownBeat June 2018) Miles Evans Talks About His Dad, Gil (DownBeat, Mar. 2019)

Miles Evans Talks About His Dad, Gil (DownBeat, Mar. 2019) Singer Allegra Levy: "Lose My Number" (JazzTimes, Dec. 2020)

Singer Allegra Levy: "Lose My Number" (JazzTimes, Dec. 2020) How I Fell In Love With Jazz – Uncle Sam's Jukebox

How I Fell In Love With Jazz – Uncle Sam's Jukebox Sarah Vaughan Jazz Vocal Competition: London's Deelee Dubé and Denmark's Sinne Eeg Shine (Jazz Times, 11/23/16)

Sarah Vaughan Jazz Vocal Competition: London's Deelee Dubé and Denmark's Sinne Eeg Shine (Jazz Times, 11/23/16) A Conversation with Catherine Russell (Jazz Times, Dec. 2016)

A Conversation with Catherine Russell (Jazz Times, Dec. 2016) Troubled Genius – The Making of Don Cheadle's film "Miles Ahead" (DownBeat, Apr 2016)

Troubled Genius – The Making of Don Cheadle's film "Miles Ahead" (DownBeat, Apr 2016) "In Jacob Collier’s Room" (DownBeat, Sept 2016)

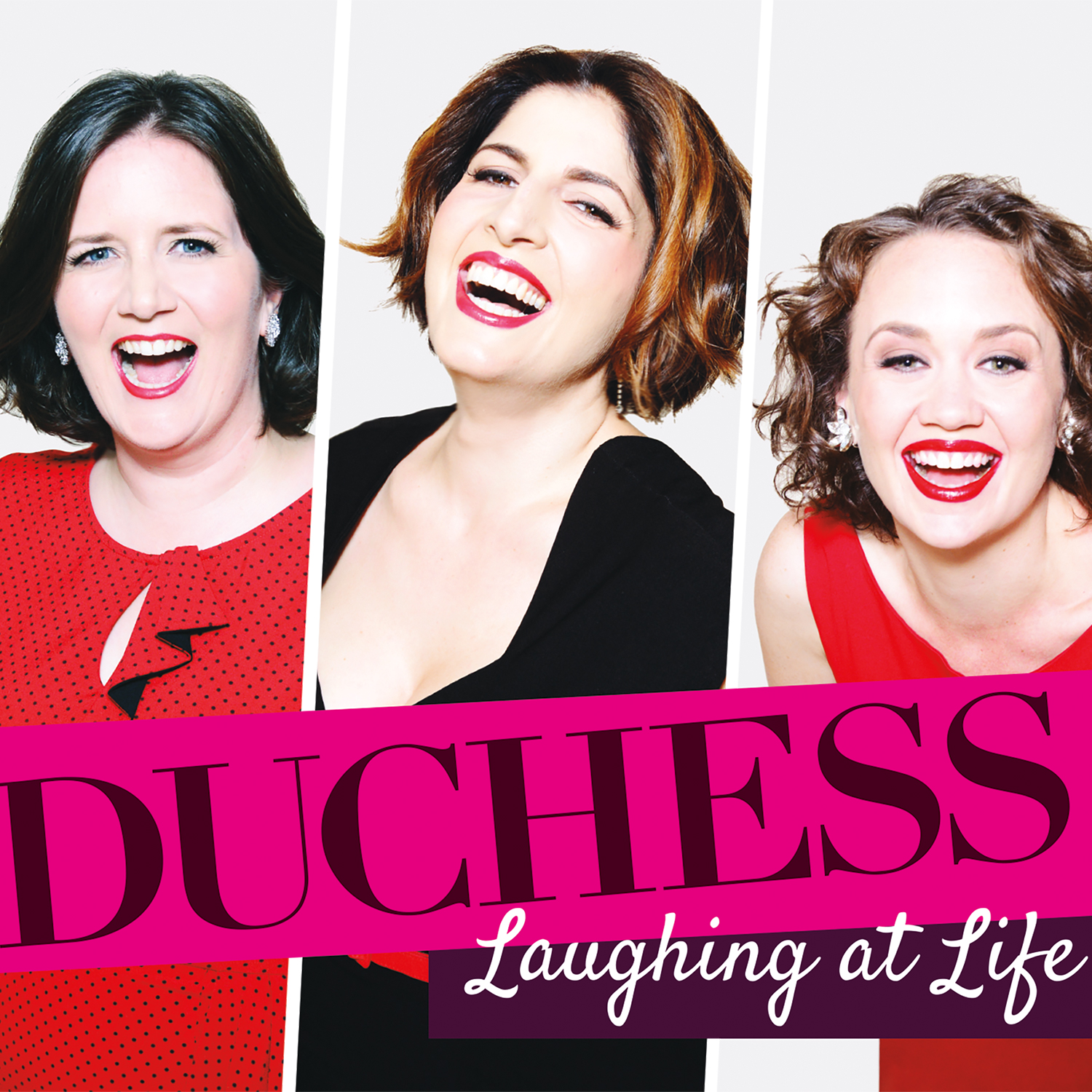

"In Jacob Collier’s Room" (DownBeat, Sept 2016) Duchess – Laughing at Life (CD Review, DownBeat 3-17)

Duchess – Laughing at Life (CD Review, DownBeat 3-17) Duchess Brings Harmony and Hijinks to NYC's 55 Bar (DownBeat, 2/27/17)

Duchess Brings Harmony and Hijinks to NYC's 55 Bar (DownBeat, 2/27/17) Trio da Paz Celebrates 30 Years Together (DownBeat, 1/3/17)

Trio da Paz Celebrates 30 Years Together (DownBeat, 1/3/17) Newport Fest Highlights Soloists and Teamwork (DownBeat.com 8/17/17)

Newport Fest Highlights Soloists and Teamwork (DownBeat.com 8/17/17) Catching Up With Russell Malone (Jazz Times, August 2016)

Catching Up With Russell Malone (Jazz Times, August 2016) Australian Singer-Pianist Sarah McKenzie, in NYC, is Thinking About Paris and San Francisco

Australian Singer-Pianist Sarah McKenzie, in NYC, is Thinking About Paris and San Francisco Bird Lives! Paquito D’Rivera revives “Charlie Parker w/Strings” at JALC (DownBeat, April 2013)

Bird Lives! Paquito D’Rivera revives “Charlie Parker w/Strings” at JALC (DownBeat, April 2013) The New York Voices — 25 Years of Vocal Excellence (DownBeat, June 2013)

The New York Voices — 25 Years of Vocal Excellence (DownBeat, June 2013) Eliane Elias at the Toronto Jazz Festival (DownBeat, 7/2/13)

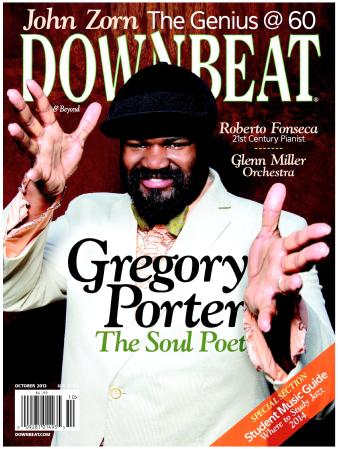

Eliane Elias at the Toronto Jazz Festival (DownBeat, 7/2/13) Gregory Porter – The Storyteller (DownBeat)

Gregory Porter – The Storyteller (DownBeat) Guitarist Ben Monder's Stunning "Hydra" (my review in Nov. 2013 DownBeat)

Guitarist Ben Monder's Stunning "Hydra" (my review in Nov. 2013 DownBeat) Donald Fagen – An Eminent Hipster Speaks

Donald Fagen – An Eminent Hipster Speaks Seven New Vocal CDs – From 'Trad' to Rad

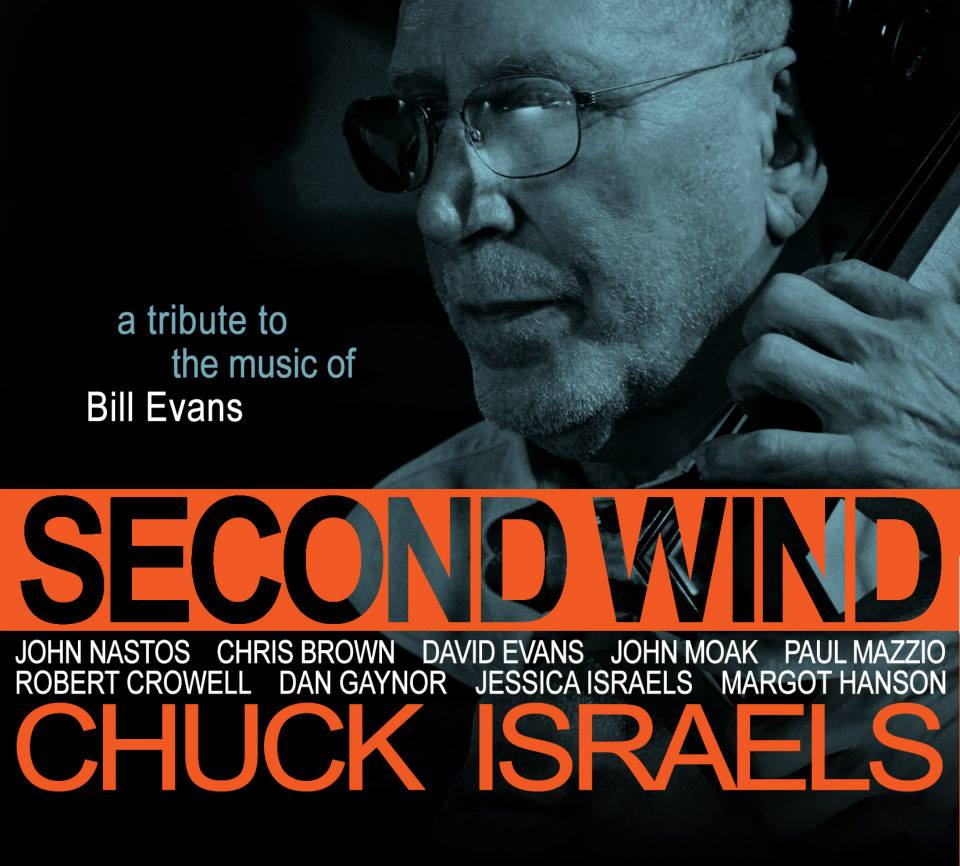

Seven New Vocal CDs – From 'Trad' to Rad "Second Wind" – Chuck Israels' Tribute to Bill Evans, his Former Partner

"Second Wind" – Chuck Israels' Tribute to Bill Evans, his Former Partner Cassandra Wilson Reprises "Blue Light" in NYC (DownBeat, April '14)

Cassandra Wilson Reprises "Blue Light" in NYC (DownBeat, April '14) Lauren Kinhan – "Circle In A Square" review

Lauren Kinhan – "Circle In A Square" review Catherine Russell – "Bring It Back" CD Review – DownBeat, Apr 2014

Catherine Russell – "Bring It Back" CD Review – DownBeat, Apr 2014 Rufus Reid: Still Evolving (DownBeat – June 2014)

Rufus Reid: Still Evolving (DownBeat – June 2014) Saxophonist Craig Handy – Serious Fun (DownBeat, March 2014)

Saxophonist Craig Handy – Serious Fun (DownBeat, March 2014) Stacey Kent Weaves a Subtle Spell at Birdland – review from DownBeat.com, 12-27-13

Stacey Kent Weaves a Subtle Spell at Birdland – review from DownBeat.com, 12-27-13 Stacey Kent – The Changing Lights

Stacey Kent – The Changing Lights Bob Dorough, 90, Is Still Hip

Bob Dorough, 90, Is Still Hip Paquito D’Rivera & Trio Corrente Light Up MIMO Fest in Brazil

Paquito D’Rivera & Trio Corrente Light Up MIMO Fest in Brazil Cecile McLorin Salvant: Young Provacateur (DownBeat cover story, 8/14)

Cecile McLorin Salvant: Young Provacateur (DownBeat cover story, 8/14) Jazz Legends of the Winter (Jazz Fest) – DownBeat 1/28/15

Jazz Legends of the Winter (Jazz Fest) – DownBeat 1/28/15 At 80, Bossa Nova Pioneer Joao Donato Isn't Slowing Down (DownBeat, 12/5/14)

At 80, Bossa Nova Pioneer Joao Donato Isn't Slowing Down (DownBeat, 12/5/14) "Chick Corea – The Music Defies Words" (DownBeat 12/14)

"Chick Corea – The Music Defies Words" (DownBeat 12/14) Taj Mahal Satisfies and Tickles, Too at SFJazz (DownBeat.com, 3/12/15)

Taj Mahal Satisfies and Tickles, Too at SFJazz (DownBeat.com, 3/12/15) Gregory Porter and All-Stars Celebrate Blue Note Records' 75th Anniversary at Sea (DownBeat, Dec. 2015)

Gregory Porter and All-Stars Celebrate Blue Note Records' 75th Anniversary at Sea (DownBeat, Dec. 2015) Jive Samba – Duduka da Fonseca (Jazz Times)

Jive Samba – Duduka da Fonseca (Jazz Times) Bossa Nova Pioneer Carlos Lyra Returns to U.S. for First Time in 50 Years (DownBeat, 6/3/15)

Bossa Nova Pioneer Carlos Lyra Returns to U.S. for First Time in 50 Years (DownBeat, 6/3/15) DownBeat Visits Catherine Russell in Studio for ‘Harlem’ Sessions (DownBeat, 12-11-15)

DownBeat Visits Catherine Russell in Studio for ‘Harlem’ Sessions (DownBeat, 12-11-15) Newport 2014 Review, Part 2 (Marsalis, JLCO, Dee Dee Bridgewater)

Newport 2014 Review, Part 2 (Marsalis, JLCO, Dee Dee Bridgewater) Bebop royalty join new vocal jazz group in historic vocalese summit (DownBeat, 9/22/15)

Bebop royalty join new vocal jazz group in historic vocalese summit (DownBeat, 9/22/15) Bill Withers Returns to Spotlight for Carnegie Hall Tribute (DownBeat, 10/6/15)

Bill Withers Returns to Spotlight for Carnegie Hall Tribute (DownBeat, 10/6/15) Guitarist Jonathan Kreisberg – The Underdog (Jazz Times, July 2015)

Guitarist Jonathan Kreisberg – The Underdog (Jazz Times, July 2015) Newport Jazz Festival 2015 – My Take (DownBeat, 8-7-15)

Newport Jazz Festival 2015 – My Take (DownBeat, 8-7-15) Turning 90, legendary drummer Roy Haynes celebrates with Pat Metheny & Christian McBride (Jazz Times, 3/16/15)

Turning 90, legendary drummer Roy Haynes celebrates with Pat Metheny & Christian McBride (Jazz Times, 3/16/15) Charlap and Friends Celebrate B'way & Harlem Tunesmiths at Jazz at Lincoln Center (DownBeat, 4/13/16)

Charlap and Friends Celebrate B'way & Harlem Tunesmiths at Jazz at Lincoln Center (DownBeat, 4/13/16) Lizz Wright: Total Devotion (DownBeat, Jan. 2016)

Lizz Wright: Total Devotion (DownBeat, Jan. 2016) Barth Brings Eloquent, Hard-Charging Swing to Mezzrow (DownBeat, May 18, 2016)

Barth Brings Eloquent, Hard-Charging Swing to Mezzrow (DownBeat, May 18, 2016) Kamasi Washington Presents Jazz-Rock Spectacle in New York (DownBeat 3/22/16)

Kamasi Washington Presents Jazz-Rock Spectacle in New York (DownBeat 3/22/16) Jon Batiste Chats About His Favorite Jazz Xmas Albums (DownBeat.com Dec 9, 2016)

Jon Batiste Chats About His Favorite Jazz Xmas Albums (DownBeat.com Dec 9, 2016) Becca Stevens Band Embraces Jazz-Folk in-Pittsburgh (DownBeat, May 31, 2016)

Becca Stevens Band Embraces Jazz-Folk in-Pittsburgh (DownBeat, May 31, 2016) Elias Revisits Brazilian Classics at Birdland (DownBeat 4-10-15)

Elias Revisits Brazilian Classics at Birdland (DownBeat 4-10-15) Brazilian singer Clara Moreno, daughter of Joyce, re-imagines a jazz samba classic (DownBeat, Nov. 2016)

Brazilian singer Clara Moreno, daughter of Joyce, re-imagines a jazz samba classic (DownBeat, Nov. 2016)

You must be logged in to post a comment.